Read more: How Intellias developed a solution that optimizes financial market data flows and turns them into useful insights. Take advantage of predictive analytics to be prepared for any outcome as part of your monthly payment. Real-time reporting and analysis of data that provides key metrics at the click of a button is essential for adjusting offers to suit customer demands. Data is secured and backed-up at regular intervals, allowing for access to information as and when needed. Advantages in regulation and compliance can be found with cloud computing, as the vendor can choose to completely secure or give partial access to the data in question. Increased security is obtained through payment tokenization and helps organizations achieve global compliance with EMV standards. Highly-secure data encryption is essential for any online business and with cloud computing, it’s all included in the package.

Buyers and sellers are brought together on shared applications, with technology implemented to ease transactions between them. The ability to scale up or down rapidly according to demand levels, enables businesses to change their product offerings in real time, creating customized solutions to improve customer relationships. Cloud computing allows for development and quick launching of new products and services, essential for keeping up with customer demands and changes in the market.

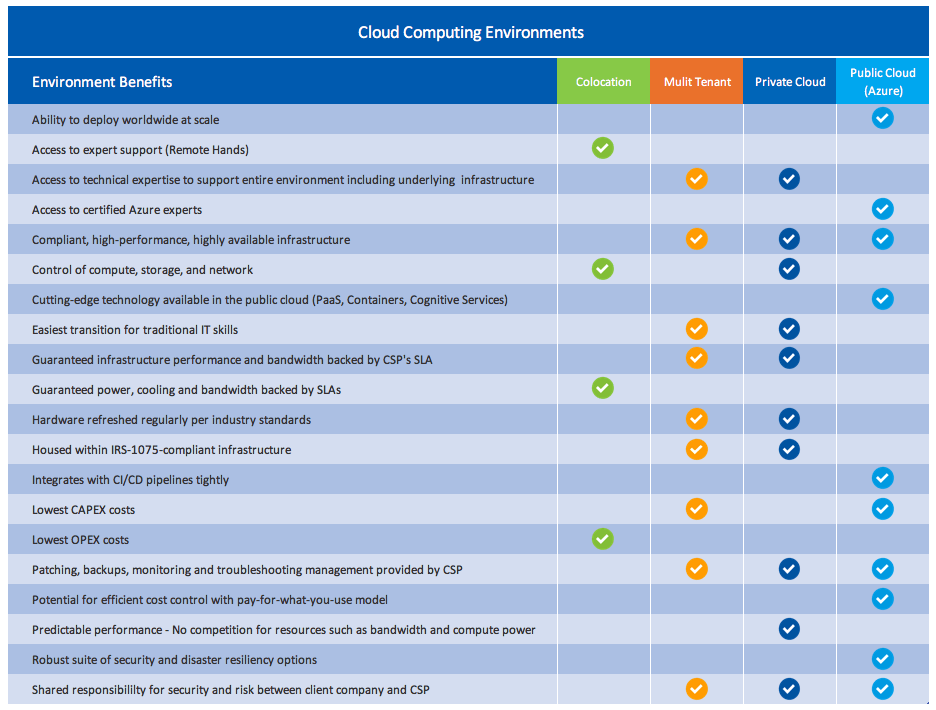

User experience is another important aspect in on-premise vs cloud comparison, as plays an integral role to the success of a financial company. Maintenance or upkeep costs are kept to a minimum as there is no physical hardware or infrastructure to maintain. Without the need to hire IT staff to maintain the network, expenditure can be reallocated to building your business and keep down wage costs. Landline connectivity is included in many plans, bundling your connectivity into one payment. The Capital expenditure (CAPEX) is practically non-existent, as no hardware is needed, nor any physical infrastructure to hold servers. The key point in cloud vs on-premise cost comparison is that cloud development platform providers charge on a pay as you go, per-user basis, so the cost involved is dramatically reduced. Generally used on an as-needed basis, companies only pay for what they use and can scale up or down to suit customer and market demands.Ĭloud services such as payment gateways, secure online transactions, and digital wallets are some of the most common examples of what’s on offer and can be utilized to secure payments for a variety of businesses. Limitless in terms of computing power and storage capabilities, cloud computing allows financial start-ups to enter the financial industry and compete on the same playing field as large financial institutions. Managing, processing, and encryption of data is left in the control of a third-party operator and offers the ability to operate real-time data reporting and analytics.

Comparing cloud services for business download#

All your critical questions are answered below in this in-depth analysis detailing the differences between on-premises and cloud solutions.Ī Powerful Combo for Next-Gen Ecosystems Download now What is cloud computing?Ĭloud computing, in its simplest form, is the process of using remote servers over the internet to host resources like emails, networking, storage, data, and software. Whether you’re a start-up trying to disrupt the industry or a large financial institution striving to improve your customer service, a few questions need to be addressed in order to choose the best solution for your business. Figuring out which is the most suitable option for your business should be simple once you’re aware of the pros and cons of each option.

Speed to market and scalability are crucial to the success rate of FinTech start-ups, so deliberate research must be faced before doing cloud vs on-premise comparison. So, what does this mean for financial technology or service providers?īusinesses from small and medium sized enterprises (SMEs)s to large financial institutions are racing to provide easy, secure and accessible payment solutions for their customers and advances in cloud development services are paving the way forward. As we delve deeper into the 21st century, technology and the way we do business is evolving and improving daily.

0 kommentar(er)

0 kommentar(er)